The mission of the New Ventures Team is to facilitate the formation of new ventures powered by Vanderbilt technology. Our objective is to be the principal partner for our faculty, staff, inventors and entrepreneurs who are exploring new venture opportunities. Our engagement model helps university inventors and entrepreneurs to better understand the new venture creation process - from ideation to formation.

The New Ventures Team serves as a catalyst for venture creation within the Vanderbilt community. We vet innovative ideas of Vanderbilt faculty, staff, inventors and entrepreneurs and search for exciting opportunities while focusing on value creation.

Vanderbilt University's

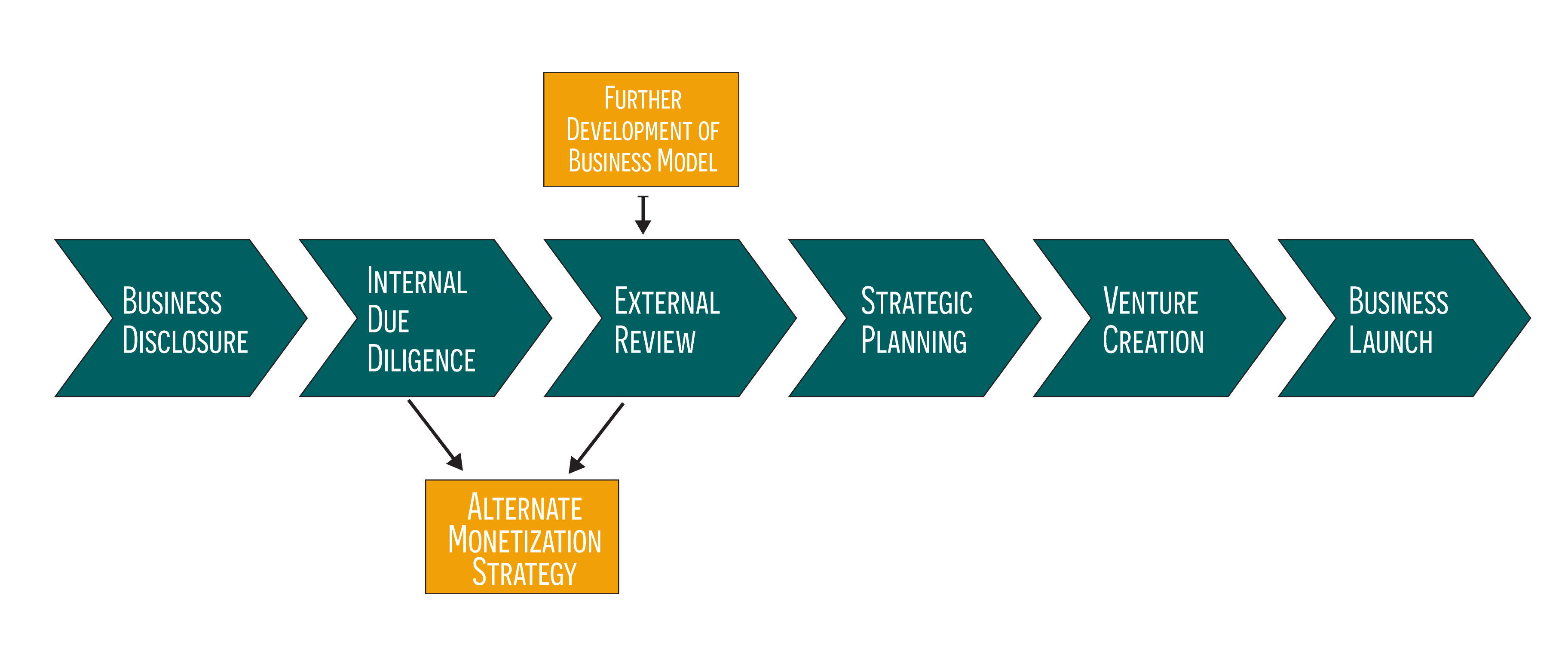

New Ventures Facilitation Process

(Click on the chevrons to go to the section)

Business Disclosure

The first step in determining the viability of a potential new venture creation involves intro-ductory meetings with the faculty, staff or entrepreneur to gather information and establish a framework for further due diligence.

This process starts with an initial meeting with the New Ventures Team where we review a detailed question/answer (Q/A) with you to help us understand the merits of the technology and the potential business. The Q/A focuses on initial evaluation of the concept in four areas: technology, market, risk (financial and legal) and team. Each category is scored on a 1-5 scale. The Q/A session allows us evaluate the following:

- Is there a sufficiently attractive market opportunity?

- Is the offered solution feasible from a market and technology perspective?

- Can we compete and is there sustainable competitive advantage?

- Is there a team that can effectively capitalize on this opportunity?

- What is the risk / reward profile of this opportunity? Does it justify the investment of time and money?

This exercise also allows us to assess the inventor’s level of engagement, understanding of market, passion for venture creation and motivation for success.

Key Actions

- Facilitate interaction, establish working relationship with inventor and gather basic information about the invention.

- Assess, evaluate and gain clarity on the basics at this ideation phase through dialogue.

- Be aware of what constitutes an invention

- Engage CTTC as early on as possible

- Estimate commercialization timeline in terms of stages of development.

- Conclude approach on venture development.

Internal Due Diligence

Our internal due diligence process is designed to answer the question, “Does it make sense to go ahead with the new venture?” The answer to this question forms the basis of the business framework in assessing viability, risk and investability of the new venture and allows us to formulate the right strategy in taking it forward.

The internal due diligence process starts with an initial meeting with the New Ventures Team where we review with you a detailed questionnaire to help us understand the merits of the technology and/or invention. The session focuses on initial evaluation of the concept in four areas: technology, market, risk (financial and legal) and team. Each category is scored on a 1-5 scale. The outcome of this exercise allows us evaluate the following:

Studying the Technology

- What is the technology and the market landscape?

- What is the current stage of development? Is it being utilized now?

- What is the status of intellectual property (IP) protection?

- How much investment will be necessary to bring the technology to market?

Defining the value proposition

- What value does the product or service deliver to the customer?

- Which one of the customer’s problems are we helping to solve?

- Which customer needs are we satisfying?

Analyzing the Cost Structure

- How much does it cost to produce?

- What are the cost drivers?

- Is there scope for optimization and scalability?

Validating the Revenue Model

- How will the venture make money?

- What is the current stage of development? Is it being utilized now?

- Can the revenue model be benchmarked with existing market offerings?

- Are there multiple revenue streams? If yes, what are the various contribution margins?

Assessing the market and competitive forces

- What is the estimated total addressable market? What are the expected growth rates?

- Who are the competitors and what is the competitive advantage?

- Who is the end customer? Is the product or service currently being sold? If so, what are the revenues and volumes?

Understanding Team Dynamics

- Does the team have the necessary experience it takes to deliver what it has set out to do?

- Does the team have the insight to identify its own weaknesses and hire good people to complement them?

- Can the team constructively deal with all the challenges that are and will occur during the life-cycle of the new venture?

Key Actions

- Perform 360-degree due diligence on the technology, team and market, and establish the business model framework.

- Analyze industry dynamics, market trends and competitive landscape.

- Establish framework for technology and business development plan.

- Hand over for external due diligence.

External Review

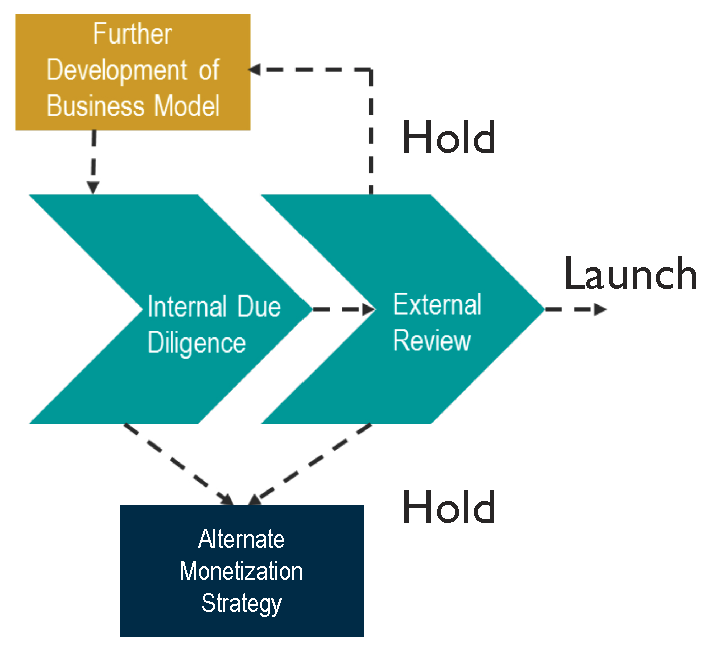

The external review process serves as a check-point to validate our conclusion based on internal due diligence and also allows us to evaluate next steps in formulating a “Launch / Hold” strategy.

The New Ventures Team has established an advisory council represented by industry experts, serial entrepreneurs, venture capitalists, angel investors and service providers (lawyers, accountants, marketing professionals etc) with the primary objective of creating an “ecosystem” that serves as a resource for new venture creation. The members of the advisory council are routinely called upon to help review new opportunities as well as to mentor existing ventures.

In addition to the external review, this process also allows us to showcase your idea to our partners at an early stage and gain perspectives and guidance from our mentor community. Our goal is to establish a transparent, iterative and collaborative process empowering you to stay engaged throughout the review cycle.

Key Actions

- Engage external advisers to evaluate new venture viability.

- Work with industry and business experts in the evaluation of new venture opportunity.

- Get feedback on “investability” of new venture.

- Solicit and recommend a “Launch / Hold” strategy.

Launch

A technology, idea or service with a clear path to monetization, scalability, attractive value proposition and an addressable market merits a “launch” in terms moving to next phase of the venture creation process. It is anticipated that only a handful of such ventures will annually move beyond this due diligence process.

Hold

We believe that every idea should be explored. As a result of our due diligence process, a majority of these will end up receiving a “hold” recommendation. “Hold” is our way of saying, “Stop, look and proceed.” A “hold” recommendation will typically fall into two categories:

Further Development of Business Model and Technology

Ideas or technologies showcasing viability however lacking merit in more than one categories classified under “launch” will require further investigation and revision of their business model. This essentially means going back to the drawing board to revalidate the technology or idea and explore alternative strategies for commercialization.

The New Ventures Team will work with Vanderbilt faculty and entrepreneurs in reassessing the busi-ness model. We will also explore assignment of mentors to help facilitate this process. Our goal is to facilitate potential.

Key questions explored:

- Are there alternative ways in which we can extend use of technology?

- Does this translate into a viable market opportunity?

- How does this influence revenues and costs?

- What is the resulting impact on competitive advantage?

- Does the venture still look fundable?

Alternate Monetization Strategy

There are certain ideas or technologies that typically are not suitable for new ventures, due mainly to: lack of significant market potential, research and design (R&D) costs and regulatory constraints. In such cases the New Ventures Team will work with the inventor and/or entrepreneur to explore alternate monetization strategies. These may include IP licensing, collaborative R&D, consulting or out-right sale of the technology.

Further Development of Business Model and Technology

Ideas or technologies showcasing viability however lacking merit in more than one categories classified under “launch” will require further investigation and revision of their business model. This essentially means going back to the drawing board to revalidate the technology or idea and explore alternative strategies for commercialization.

The New Ventures Team will work with Vanderbilt faculty and entrepreneurs in reassessing the busi-ness model. We will also explore assignment of mentors to help facilitate this process. Our goal is to facilitate potential.

Launch

A technology, idea or service with a clear path to monetization, scalability, attractive value proposition and an addressable market merits a “launch” in terms moving to next phase of the venture creation process. It is anticipated that only a handful of such ventures will annually move beyond this due diligence process.

We believe that every idea should be explored. As a result of our due diligence process, a majority of these will end up receiving a “hold” recommendation. “Hold” is our way of saying, “Stop, look and proceed.” A “hold” recommendation will typically fall into two categories:

Hold

There are certain ideas or technologies that typically are not suitable for new ventures, due mainly to: lack of significant market potential, research and design (R&D) costs and regulatory constraints. In such cases the New Ventures Team will work with the inventor and/or entrepreneur to explore alternate monetization strategies. These may include IP licensing, collaborative R&D, consulting or out-right sale of the technology.

Key questions explored:

- Are there alternative ways in which we can extend use of technology?

- Does this translate into a viable market opportunity?

- How does this influence revenues and costs?

- What is the resulting impact on competitive advantage?

- Does the venture still look fundable?

Alternate Monetization Strategy

Ideas or technologies showcasing viability however lacking merit in more than one categories classified under “launch” will require further investigation and revision of their business model. This essentially means going back to the drawing board to revalidate the technology or idea and explore alternative strategies for commercialization.

The New Ventures Team will work with Vanderbilt faculty and entrepreneurs in reassessing the busi-ness model. We will also explore assignment of mentors to help facilitate this process. Our goal is to facilitate potential.

Launch

A technology, idea or service with a clear path to monetization, scalability, attractive value proposition and an addressable market merits a “launch” in terms moving to next phase of the venture creation process. It is anticipated that only a handful of such ventures will annually move beyond this due diligence process.

Hold

There are certain ideas or technologies that typically are not suitable for new ventures, due mainly to: lack of significant market potential, research and design (R&D) costs and regulatory constraints. In such cases the New Ventures Team will work with the inventor and/or entrepreneur to explore alternate monetization strategies. These may include IP licensing, collaborative R&D, consulting or out-right sale of the technology.

Strategic Planning

Receiving a “launch” after the internal and external review process results in the inventor and/or entrepreneur and the New Ventures Team collaborating to create a strategic road-map for the proposed venture.

The strategic planning process lays the foundation for a successful business venture. The New Ventures Team will leverage its experience and resources to help establish the framework for the business, develop the mission statement, value proposition and formulate an effective market strategy.

This engagement step is a critical as it involves defining core elements of the business model and estab-lishing foundation for the business plan.

Key Actions

- Define the business mission and set corporate objectives.

- Analyze the external environment and internal environment through SWOT (Strengths, Weakness, Opportunities, Threats) analysis.

- Formulate competitive strategies and develop tactical plans.

Venture Creation

Venture Creation serves as an extension of the business planning process and evaluates viability, marketability and investment potential which can be translated into a business plan. It is an analysis that captures the findings made in discovery and due diligence.

The New Ventures Team plays a primary role in the completion of a comprehensive business plan including development of financial and valuation models and an assessment of funding needs. This is a collaborative effort with inventors and authors.

An integral part of developing the business plan involves addressing core elements of the new venture, specifically:

- outlining business strategy and revenue model,

- access to addressable markets and customers,

- competition and competitive landscape, and

- financial projections.

Key questions addressed during business plan development:

- What does the business do? (value proposition)

- How is it going to make money? (business / revenue model)

- Why does it make sense to do this? (market opportunity)

- Who else does this and what makes the proposed technology or product better than others? (competition and competitive advantage)

- Who are the people behind the business? (inventor expertise)

- How much money does the business expect to make? (financial projections)

- How much money does the business need, to make what it expects to make? (Funding requirements)

- How will investors realize ROI? (exit strategies)

In addition to the above, this process will also involve assessment of funding needs. Parameters used in this assessment are:

- Implied ownership cost (enterprise value)

- Type of investor (angel, venture, other)

- Company stage (concept / idea, prototype, seed)

- Investment amount (need NOT want)

- Type of investment (equity, debt, convertible)

- Investment framework / terms (delivery in stages, or tranches based on milestone achievement, triggeringevents)

- Use of funds (spending breakdown)

Key Actions

- Develop business plan.

- Develop financial and valuation models.

- Analyze funding needs and use of funds.

Business Launch

Once we have successfully vetted the opportunity, created the strategic framework, devel-oped the business plan and established funding needs and organizational structure, the final step in the New Ventures process addresses key elements associated with launching the new venture.

Formation of Management Team

The evolution of a venture from concept to formation will go through several iterations. At this juncture, it becomes increasingly important to ensure that we provide support in establishing a management team that has the capacity to launch the new venture.

Objective

- Identify “talent gaps”.

- Leverage Vanderbilt ecosystem to attract outside experts.

- Establish management structure.

- Create organizational frame-work.

Outcome

- Improves efficiency in decision making process.

- Allows inventor to focus on his area of expertise.

- Facilitates cross-functionality and collaboration among team members.

- Opens doors to strategic networks.

The management selection process is a delicate exercise that can make or break the new venture’s ability to thrive. Criteria addressed when selecting top management:

- Track record as an entrepreneur.

- Technical or commercial competency.

- Ability to resolve conflicts quickly and constructively within a team.

- Good understanding of assumptions and metrics about market and competitive landscape.

- Combination of both conflict resolution skills and communication skills.

Incorporation of entity

Once we have established a management team, the next step involves assisting with the legal organization of the new venture. This allows us to distribute equity interests to all Vanderbilt stakeholders in conformi-ty with Vanderbilt policies.

Key considerations:

- What is the best structure for incorporating the new venture (LLC, S-Corp, etc.)?

- How does the structure benefit investor and other stakeholders?

- What are the risks associated with the structure?

- Who are the key decision makers and what are their roles as executives of the company?

Establishing Board of Directors

On a case by case basis, the New Ventures Team will play an active role in the formation of a new compa-ny’s board of directors. At this early stage, it is often the case that the board will consist of key members of the management team along with mentors and advisors who may be assisting the new entity. As the venture grows, and especially once outside investors are involved in the company, the board will add out-side directors who influence how the company is run.

In building a board of directors the company should seek directors who have technical expertise or deep market or sector knowledge. A typical early-stage board will consist of five or seven members (to avoid deadlocks when voting on various items). In certain instances, a Vanderbilt employee may serve on a new company’s board, especially in the company’s early stage, due to their technical or market expertise. The New Ventures Team will work with the company to find those optimal board members.

New Ventures Advisory Council and Mentor Network

The New Ventures Team will facilitate introductions to its advisory council and mentor network. These groups will support new company management and will typically be subject matter experts having startup experience.

Key objectives for advisory council members and mentors who work with the companies include:

- To add immediate validation and credibility to the venture at a stage when it is needed.

- Opening doors, making introductions and assisting with strategy and business planning.

- Making introductions to potential investors or serving as a due diligence reference during fundraising.

Advisors know people and people know advisors. It’s that simple. The more third parties talking about your venture the better.

Licensing of Intellectual Property (IP)

Licensing ensures that the intellectual property (IP) developed by the Vanderbilt inventor is transferred to the new entity. This transfer of technology gives the newly formed entity a legal right to use the IP for commercial purposes. Issues addressed during the license negotiations include: field of use, royalty and other payments, ownership rights, due diligence, milestones, and others.

Every licensing agreement is unique and crafted to the needs of the transaction by an experienced licensing officer. The New Ventures Team will work with the licensing officer at Vanderbilt to ensure this process is completed in a timely and efficient manner. For additional details on the licensing process, visit www.vanderbilt.edu/cttc.

Funding

Funding for new ventures may come from one or more sources, including grants, angels and investors. The New Ventures Team will work with the company to identify these sources of investment to ensure they are the right match.

Our role in the fund raising process will include:

- Identifying potential angels, venture capital firms (VC’s), and strategic investors that are suitable matches for the company.

- Initiating introductions to potential investors.

- Providing support in preparing investor related documents (pitch decks, valuation models, executive summaries, etc.).

- Providing access to our advisory council and mentor network to work with companies through the fundraising process.

- Providing strategic support in deal negotiation, structuring and other advice-related to the funding process.

Key Actions:

- Identify management team and board of directors.

- Assist in setting up business entity.

- Facilitate access to the New Ventures Team Advisory Council and mentor network.

- Complete IP licensing (Vanderbilt to new venture).

- Engage potential investors (Angels, VC’s, Strategic Investors).

Economic Development

The New Ventures Team manages and supports activities related to economic development, specifically outreach and strategic initiatives within the middle Tennessee entrepreneurial, investment and startup communities. This is a focused effort to foster innovation and accelerate technology transfer in a manner consistent with Vanderbilt’s tradition of academic excellence, public service and commitment to society.

Key initiatives include:

- Organization of events, workshops and seminars that relate to and support entrepreneurship, including educational and entrepreneurial outreach within Vanderbilt community.

- Alliances with local and regional groups supporting innovation and venture creation such as:

- Nashville Entrepreneur Center,

- Life Science Tennessee,

- StartUp Tennessee,

- Nashville Chamber of Commerce,

- etc.

- Strategic partnerships with members of the investment community such as: HNIs, Angels, VC’s, etc.

- Collaboration with Vanderbilt’s Owen Graduate School of Management, Engineering School and Medical Center to establish cross-functional programs.

- Consulting and internship opportunities for the Vanderbilt student community to get involved and stay engaged with the CTTC and New Ventures Team.

New ventures working with CTTC benefit by our connection to groups in middle Tennessee and the state who focus on economic and community development. These relationships help new ventures to integrate with and into growing industry and technology segments of the regional economy. These relationships are important.

Connecting Vanderbilt new ventures to this broader entrepreneurial ecosystem also assists in the growth of new and innovative segments of the economy. Often, a significant source of technology in specific areas (drug discovery, for example) is represented by invention at Vanderbilt. Creating relationships focused on economic and community development benefits the economy at large, as well as companies commercial-izing Vanderbilt technology.

Resources

Funding:

- Angel Investor Network

- Angel List

- Grants.gov

- National Venture Capital Association (NVCA)

- SBIR / STTR Grant Information

- Small Business Administration

- V Finance

Frameworks, Strategies, Tools & Other Bits:

- Business Model Generation

- Developing a Compelling Pitch

- Entrepreneurship.org

- Getting Started as an Entrepreneur

- Interactive Coaching

- Kauffmann Foundation Entrepreneurship Center

- KissMetrics Entrepreneurship Handbook

- SBA Business Plan Template

- Startup Marketing

- Start Up Pitch

- Startup Toolkit

Legal:

- Free Legal Documents

- Legal Documents for Your Startup

- Legal Resource Guide For Entrepreneurs

- NVCA Model Legal Documents

- Series Seed

- StartupPercotalor

Regional:

- Angel Capital Group

- CET Life Sciences Center

- Cool Springs Life Sciences Center

- Emerge Memphis

- Gig City

- JumpStart Foundry

- Launch Tennessee

- Memphis Bioworks

- Nashville Area Chamber of Commerce

- Nashville Business Incubation Center

- Nashville Capital Network

- Nashville Technology Council

- Owen Entrepreneurship Center

- Startup Tennessee

- Tech20.20

- Tennessee Small Business Development Centers

- The Cumberland Center

- The Nashville Entrepreneurship Center

- Venture Nashville

- Williamson Country Chamber of Commerce

- Zeroto510